The digital disruption of financial services began over two decades ago when the dot-com boom of the late 1990s set off the rapid adoption of the internet. While this was the first of many dominoes to fall, the digital disruption witnessed during the recent COVID-19 pandemic spurred unprecedented changes in how incumbent banks operated and people functioned.

What is digital disruption?

Any radical and fundamental transformation to an existing industry, culture or market due to emerging technological innovation is known as digital disruption.

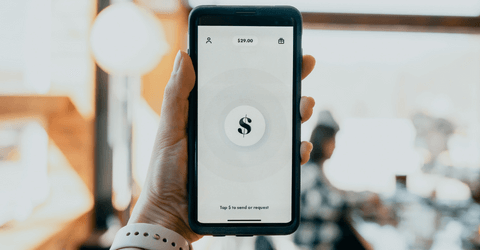

Since time immemorial, banks have been a core driver of countries’ economies. But now with a smartphone in everyone’s hand and numerous new fintech services such as neobanks available at a user’s fingertips, banks are struggling to retain the foothold they used to possess to retain their customers.

Why are neobanks so popular?

One of the primary reasons why neobanks are fierce competition for traditional banks is because they are wholly digital and do not have any branches. Modern-day consumers are always on the move, between work and other commitments, they no longer have the time to stand in long lines or skip engagements just to get their bank work done. The thing they look for in everything is convenience, and neobanks offer exactly that. This makes them a go-to option for the tech-savvy working class since they offer most services that regular banks offer such as payments, debit cards, credit cards, money transfers, lending, and more.

In the United States of America, the market size of the neobanking sector was valued at $45 billion during the year 2021 and is projected to reach $600 billion by 2028. In West Africa, where the reach of mobile money is 13 times wider than local banks, a mobile money-based company named MTN launched its IPO and raised over $200million. While the 10 most funded neobanks in Africa have raised a combined $688 million across 35 rounds.

How can banks survive digital disruption?

For the longest time, banks have stayed resistant to digital disruption, making very slow changes to their functioning to match the new digital landscape. But due to the rapidly changing ecosystem, banks have no choice but to upgrade their tech infrastructure and modify their services if they wish to remain the go-to players in the financial market.

“By partnering with fintech startups, banks will give their account holders the right measure of security and speed. Account holders can know that their money is safe, and they can enjoy the latest financial technology. This is the way to become a digital bank,” says financial author Chris Skinner.

Research by McKinsey & Company projected that incumbent banks that are digital laggards could see up to 35% of net profit eroded, while those who adapt to the new digital environment are likely to witness a profit upside of 40% or more. And that’s exactly why banks like J.P. Morgan invest nearly $12 billion a year in technology.

“Everyone is talking about the disruption of the normal financial process. If until recently the financial world was considered grey and dull, today it is a very vibrant industry and technology produces opportunities and creative thinking,” says Ziv Gafni, who is Head of Digital Strategy, Fintech & Markets Innovation at JP Morgan.

With the help of Artificial Intelligence and Machine Learning, traditional banks can increase the personalization of services and reduce error rates all while processing and generating insights from vast troves of data.

It will also help them offer speed and agility to their customers, most of whom they have a long-lasting trust relationship. As David Malpass, President of the World Bank Group once said, “Digitalisation increases productivity, money-making capacity and entrepreneurism, which are all so important to growth.”

Every sector, especially those that are integral to the functioning of society, is bound to face friction due to the ever-evolving digital disruptors. While the internet and websites were the digital disruptors of the 1990s, and neobanks are the new primary digital disruptors, incumbent banks will have to learn to go with the tide or face serious losses.