While Chat GPT and Nvidea are driving the Generative AI hype and investment in the tech markets, tokenization is the buzzword for the CEO’s of leading financial institutions.

When Wall Street CEOs talk, the markets listen, and when they speak of digital innovation, everyone from politicians to coders pay attention. A decade ago, only West Coast tech CEOs talked about tokenization’s potential.

But what are these global leaders talking about, what does tokenizing financial markets mean?

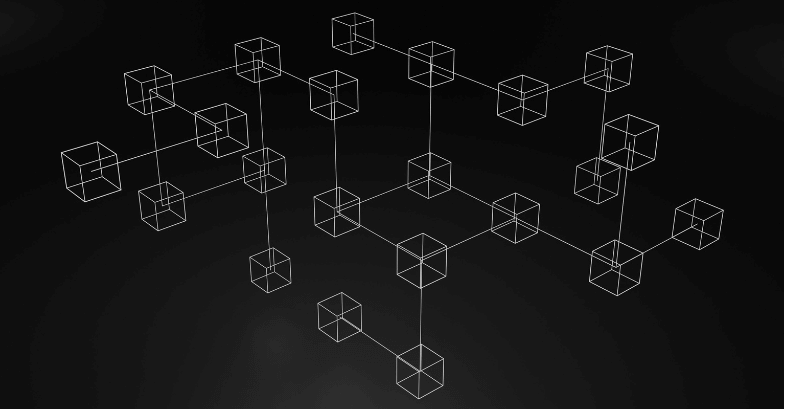

Tokenization in financial services describes the next generation of the digitization of stocks, bonds, and funds that are dematerialized into digital tokens on digital ledger technology (DLT).

Digital tokens are codified in a “smart contract”, a self-executing digital agreement, with rules for the investment and terms for coupons, dividends, and settlement, embedded in the token’s computer code and executed when the rules and terms are met – the era of programmable money is here.

DLT is a distributed file sharing technology with a cryptographic layer of cyber security protection that enables tokens to be bought, traded, and sold in an easier, more efficient, and digitally safer way than we do today. DLT connects the networks of financial services providers tokenized products into a seamless market accessible to investors.

A recent BCG / ADDX analysis estimates that tokenization is a $16 to $68 trillion market opportunity over the next 6 years.

This new technology comes with the promise of 24/7/365 buying and selling of tokenized financial products that are in many cases cheaper, faster, and smarter than today’s products and offer greater opportunities for investors to access new markets, products, liquidity, and to better collateralize their investments for greater returns.

Two recent surveys from EY-Partheon of high new worth (NHW) and institutional investors indicate that 61% of investors plan to invest in tokenized assets by the end of 2024 with the top three priority assets class spanning private equity, real estate, and private debt.

Tokenizing physical assets such as real estate or commodities like gold are often referred to as “digital twins”. Unlike tokenized stocks or bonds which can be “digital native”, the physical asset is “twinned” with the dematerialized digital token that holds the rights, obligations, and rules for the asset and investment.

Fractionalization of assets that are tokenized offers the promise of opening investment opportunities to a larger market by significantly reducing the minimum investment amount required. Investing modest amounts in a luxury property, precious metal, fine art, and collectibles and enabling investor access to the same investments that professional investors and millionaires make, is high on the priority list.

Several leading U.S. financial institutions have now launched bitcoin ETFs available to investors through regulated and secure platforms. Blackrock’s bitcoin ETF is the fastest growing ETF in history and reveals the pent-up demand that has been accumulating in for bitcoin investments in the U.S. where cryptocurrencies are a politically charged topic.

Cryptocurrencies have a mixed reputation and are often conflated with RWA tokenization in the eyes of the public, investors, regulators, and politicians. Though cryptocurrencies and tokenized RWAs both use DLT, they are very different financial products and exist across different unregulated and regulated markets.

The challenge for digital innovators is how to best communicate the incentives and benefits of RWA tokenization to scale to mass adoption while avoiding the dFMI technical jargon that puts many off. The answer is often “just do it”, and the number of tokenized products in the market is increasing.

Like many technologies that transformed society, it is often only the innovators, about 2.5% of the population according to Early Majority Theory, who can see the big picture and the value of the technology to society in the early days of development.

Henry Ford said of the automobile, “If I had asked my customers what they wanted, then they would have said a faster horse.”

The age of the automobile profoundly changed society through personal freedoms to get to new jobs and access goods and services in a way never envisioned when the horse did the job. The impact that the fourth industrial revolution is now having on society is equally profound.

With inexpensive and readily available computing on our smart phones connected to the network, and in the hands of billions of consumers, our daily habits, routines and in some cases, our lives have been dramatically changed in a way most could not have envisioned a decade ago before the smart phone.

We spend on average over three hours a day on our smart phones – texting, reading, listening, watching, shopping, banking, working, ordering, booking, and more. Financial services are at the heart of this digital relationship with our smart phones helping us to move money, pay for things, borrow, trade, and invest.

Economies are decentralized, finance will be decentralized, and it will be decentralized efficiently and safely through DLT and tokenization.

We have a decade ahead of us to further scale tokenization in financial services to mass adoption like Ford achieved with the Model T. Innovators must remain vigilant – the market is the arbiter of discretion – most people don’t care about the alphabet soup of technologies like dFMI, DLT, or tokenization.

Most people just want to access investments seamlessly through their smart phones and don’t care about the underlying technology – they just want it to be easy and secure, and they want it to work and do the job of making them money.

About the Author:

Lawrence is the CEO of Avrio, a digital financial market infrastructure provider, and has held roles chairing and managing alternative investment funds in managed futures, energy, and global reinsurance, following a career in Big 4 advisory services serving the financial services sector. He is the Chair of Global Digital Finance (GDF), a not-for-profit association promoting fair and transparent markets for digital assets and has held several member and trade association board roles. Lawrence has an MBA, is a regular Forbes and Fintech.TV contributor, and promotes ethical and sustainable finance policies for a transparent, secure, and quality digital future for everyone.