- 15 Global Companies Launch Trusted Tech Alliance for Secure Digital Infrastructure

- Singapore Management University Launches Business AI Master’s Programme

- Cochin Shipyard Seeks Global Partners to Expand International Ship Repair Footprint

- OpenText Names Former IBM Americas President Ayman Antoun as CEO

- Fintech Company Network International Appoints Ashish Jain as Group CFO

Leadership Lab

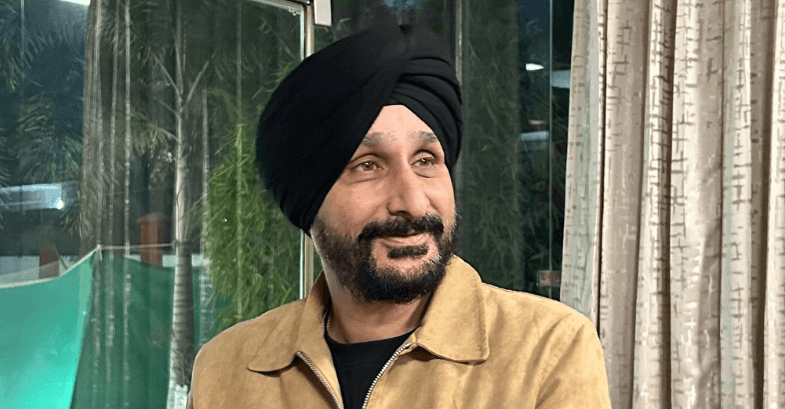

With over two decades of leadership in fire protection and security systems, including 17 years in the Middle East, Rajbir Singh has earned himself a reputation for delivering mission-critical safety solutions. As Managing Director of Green Light International LLC in Oman, he combines technical expertise with strategic business acumen, overseeing complex projects across industrial sectors. In this candid conversation, Singh shares insights from his career progression, discussing how early experiences shaped his commitment to rigorous safety standards. From implementing advanced fire protection systems to guiding Green Light International’s expansion in Oman, he offers valuable perspectives on maintaining excellence in an evolving industrial landscape.

- What initially drew you to this industry, and when did you realize it was your passion?

I was drawn to the fire protection and safety industry because of its vital role in saving lives and safeguarding assets. Early in my career, I worked on a project that left a lasting impression—designing and implementing a fire protection system for a high-risk industrial facility. The complexity of the challenge and the knowledge that our work directly impacted people’s safety sparked a deep sense of purpose in me.

I was also fortunate to have a mentor who stressed the importance of ethical practices and innovative thinking. Their guidance helped me see how this industry aligns with my values and long-term aspirations. Over the years, seeing the real-world results of my work, whether it’s creating safer environments for employees or hearing heartfelt thanks from clients, has strengthened my passion for this career. These moments remind me why I chose this path and motivate me to contribute meaningfully.

- What was the key turning point or milestone as you progressed in your career?

A pivotal moment in my career came when I was entrusted with a leadership role overseeing a major project for a large industrial client. The project required designing and implementing a state-of-the-art fire protection system tailored to complex and unique site conditions. Successfully delivering this initiative brought our team well-deserved recognition and strengthened my confidence in managing large-scale, intricate projects.

Another significant milestone was Green Light International’s expansion into Oman’s market. Being actively involved in the strategic planning and execution of this endeavor provided invaluable insights into market dynamics and allowed me to grow professionally and personally. Seeing our efforts introduce advanced safety solutions to a new region was gratifying, elevating our reputation while making a tangible difference.

- What core values drive your leadership approach?

A core value that shapes my leadership is a commitment to continuous improvement in the systems we design and how we function as a team. I firmly believe that fostering a culture of learning and innovation is essential to staying ahead in the fire protection industry.

One accomplishment I am particularly proud of is leading a sustainability-focused initiative at Green Light International. We implemented environmentally friendly fire protection systems for a client committed to sustainability, successfully balancing advanced technology with reduced environmental impact.

Another key experience was spearheading an internal development program to upskill our team. By organizing technical workshops and encouraging certifications, I’ve witnessed our team grow more confident and capable, directly enhancing the quality of service we deliver.

A deep belief in trust and empowerment is at the heart of my leadership approach. I’ve found that when people feel supported and trusted, they naturally take ownership of their work and perform at their best.

- How has your leadership style evolved over the years?

Over the years, my leadership style has evolved significantly, shaped by both successes and challenges. Early in my career, I was more task-oriented, with a strong focus on efficiency and achieving results. However, I soon realized that effective leadership is about understanding and empowering people.

I’ve since adopted a collaborative approach, fostering open communication and valuing the contributions of every team member. This has helped create a sense of ownership and accountability, which has been key to keeping teams motivated and engaged. One of the strategies I prioritize is focusing on individual development. By recognizing people’s unique strengths and providing growth opportunities, I’ve seen team members exceed expectations.

For instance, I mentored a junior team member during a critical project, helping them build confidence and skills. Eventually, they stepped into a lead role and delivered outstanding results. Moments like these reaffirm that investing in people is just as important as achieving project goals.

- What would your advice be for budding leaders entering this industry?

My advice to aspiring leaders in the fire protection and safety industry is to start by building a solid foundation of technical expertise while also honing essential soft skills like communication and teamwork. This field demands precision and strict adherence to high standards, so paying attention to detail and committing to continuous learning is vital.

Adaptability is another key quality to cultivate. Each project brings its own set of challenges—whether it’s navigating complex regulatory requirements or addressing the unique needs of a client. Being open to innovation and flexible in your approach will help you stand out.

One common hurdle for new leaders is balancing the immediate demands of projects with the need for long-term strategic thinking. I recommend fostering strong relationships within your team and actively listening to their insights to navigate this. Collaboration leads to better outcomes and strengthens trust, which is essential for effective leadership.

Lastly, always prioritize ethical practices and place safety above all else. The stakes in this industry are high, and your decisions directly impact lives. Leading with integrity and purpose not only earns respect but also ensures a lasting, positive legacy in the field.

Modern leaders have to handle a lot. A lot more than used to be expected of them. No longer just expected to steer the ship, it seems they’re supposed to be the emotional anchors of their teams too. ...

Rashmi Aiyappa is a one-of-a-kind visionary who defies categorization. A spiritual scientist, inventor, and serial entrepreneur, she pioneered Aashwasan Science®, an experiential science that helps...

As Managing Director of Majestique Landmarks, Manish Dwarkadas Maheshwari has taken his family’s legacy of excellence from textiles into real estate, where his name has become a hallmark of trust in...

Are you running a company and wondering what expectations you can have for your team? Do you sometimes scratch your head and wonder if they really “get” it? Or do you ever feel like you’re playing...

Many of us say we like change but change can also bring the feeling of terror, particularly if it’s unexpected or we can only imagine a bad outcome. That physical churn in the pit of your stomach, an...

Lucy Hedges is a prominent figure in the world of technology, journalism, and broadcast media. As the former Metro Tech Editor, presenter for the BBC Travel Show and BBC’s The One Show, and Home Tech...

When planning for the future of your business, succession planning becomes crucial, especially if the business is a significant part of your legacy. Unlike personal wealth, which can be directly...

Despite the fact that the digitalisation of trade has long been regarded as essential for enhancing global supply chains and facilitating much needed access to trade finance, progress has been limited due...

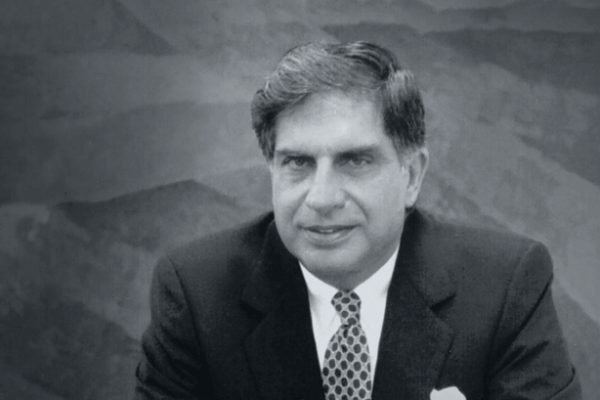

On a quiet evening in Mumbai on 9th October 2024, the business world paused as news spread of the business mogul Ratan Tata’s passing at the age of 86. The visionary who had guided the Tata Group...