- Singapore Management University Launches Business AI Master’s Programme

- Cochin Shipyard Seeks Global Partners to Expand International Ship Repair Footprint

- OpenText Names Former IBM Americas President Ayman Antoun as CEO

- Fintech Company Network International Appoints Ashish Jain as Group CFO

- Sony and TCL Agree Strategic Partnership to Form Global Home Entertainment Joint Venture

Thought Leadership

The IRECMS 2022 witnessed a fantastic turnout of delegates from across the world. With over 300 attendees, the conference showcased 40 + speakers. Bringing together professionals from Community Management, Property Management, Facilities Management, and the PropTech industry – IRECMS left the attendees with many actionable takeaways. The event consisted of four eventful days of insightful masterclasses, thought-provoking discussions, and ending with a glamorous awards ceremony.

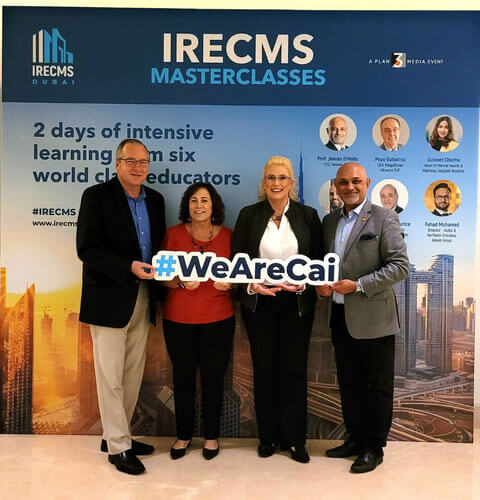

On the first day, the audience was treated to special IRECMS Dubai Masterclasses that focussed on Brand Building, Condo Technology, and Stress Management. It was a houseful event that witnessed over 100 attendees. The day showcased some of the best international and regional trainers, who presented power-packed sessions catering to the built environment.

This year, IRECMS Masterclasses were welcomed in 6 countries and concluded in Dubai. After witnessing an astounding response in Madrid, the Kingdom of Saudi Arabia, Bahrain, India, Milan, and Bogotá – Dubai too witnessed an audience of 100 professionals from the built environment.

For day two at the event, for the first time, IRECMS hosted the first-ever CAM G10 Summit. This is a congregation of leaders from the Community Association Management (CAM) industry from 10 countries, where they exchanged thoughts and best practices to propel the profession forward globally. The inaugural edition of the CAM G10 Summit witnessed representatives from UAE, USA, Spain, Colombia, Panama, Brazil, Italy, Uruguay, South Africa, Japan, and Australia. After an opening address by Pepe Gutirrez, CEO, MagniFicas, the stage made way to Tom Skiba, CEO of Community Associations Institute & Jessica Towles, the President of Community Associations Institute. They presented a research paper for CAM Leaders and touched upon the current issues facing CAM Companies in the USA. Each representative highlighted insightful points that marked a day with multiple takeaways.

On day 3, which marked the IRECMS conference, the event was inaugurated by Mohammad Bin Hammad, Senior Director, RERA, Land Department, Dubai. And Dr. Marshall Goldsmith, the #1 Business Coach and four-time NYT Bestseller, graced the event for an exclusive keynote session. Held at the Dubai Address Marina, the Conference Day focussed on interesting panel discussions. Some of the key topics that were explored were the integration of imaginative building design & management, how Community Management professionals can protect themselves in this industry, and the importance of Metaverse in the Built Environment that concluded the events of day 3.

On day 4, IRECMS 2022 concluded with a Gala Awards Ceremony which honored and recognized the amazing work of those who manage UAE’s built environment. The journey started with various companies across the UAE nominating their organizations for the IRECMS Dubai Awards 2022. After a stringent shortlisting process, 39 companies were shortlisted to compete in the final rounds. With a process that spanned over months of collective assessment by 26 Jury members, they selected the Winners & Runners-Up across 25+ categories. The awards truly meant a lot to those companies as they won them purely on the merit of their nomination.

IRECMS Dubai has all the hallmarks of a landmark event, especially given its timing when real estate management is undergoing a structural, tech-driven shift. This juncture called for a global professional association. And Plan3Media, along with Presenting Sponsor MYBOS, and Association Sponsor PROVIS, have responded to the need rather resoundingly by hosting yet another successful edition of IRECMS.

A great world is possible only when men are educated about the empowerment of women. A great world is possible only when women dare to dream and achieve big. A great world is possible only when men and...

The speed of the FTX collapse into bankruptcy appeared to precipitate the indictment of its celebrity founder and CEO. Sam Bankman-Fried (SBF) is in custody with eight criminal charges including fraud. An...

Written by Joanna Gaudoin The term office politics almost always provokes a groan. Typical words associated with the term include gossip, cliques, the ‘in crowd’, secrets, game playing, people being...

Our current economic climate has thrown the inner workings of many industry sectors into sharp relief. Healthcare arguably tops the list of the industries most affected in recent years. A global pandemic...

The case for gender equality in the workplace is overwhelming, yet progress remains at a glacial pace. In fact, we are getting further away from gender parity at work: the World Economic Forum reported...

Written by Felicity Dwyer An important leadership skill is an ability to connect with others. Leaders need to be able to communicate at all levels both internally and externally and to inspire other...

Written by Contributing Writers, Lawrence Wintermeyer and Marcos Allende Lopez Over the past two years the world suffered from a health crisis caused by the COVID-19 virus that took more than 6.5 million...

Written by Contributing Writers: Chris Altizer and Gloria Johnson-Cusack Talking about diversity, equity, and inclusion in the workplace seems to have gotten more instead of less difficult....

As we wrestle with the conundrum of how to outperform amid global unrest, surging inflation, skill, and supply shortages, we bemoan the absence of the charismatic leaders of the past. Where are all the...