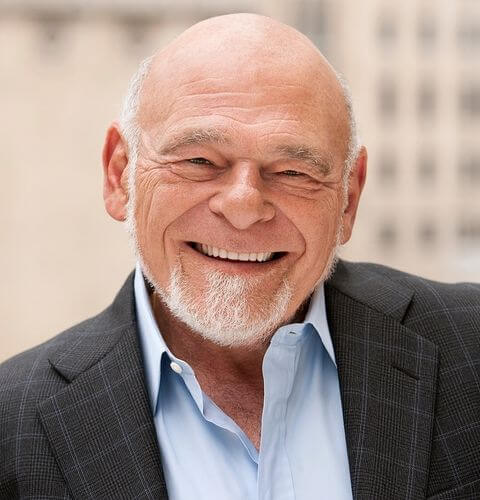

Sam Zell is a global, industry-agnostic entrepreneur and investor. He has a long track record of turning around troubled companies and assets, leading industry consolidations, and bringing companies to the public markets. His current investments are in logistics, health care, manufacturing, agribusiness, energy, and real estate. Sam is the chairman of Equity Group Investments, the private investment firm he founded more than 50 years ago. He also chairs three companies listed on the New York Stock Exchange: Equity Residential, an apartment REIT; Equity LifeStyle Properties, a manufactured home community and resort REIT; and Equity Commonwealth, an office REIT.

Sam Zell was born in 1941 in Poland and migrated to the United States in 1938, shortly before the dreaded holocaust began. The experience left a lasting impact on the young boy.

He says, “As a child of Holocaust survivors, my upbringing was shaped by the constant awareness of the close brush with extermination my family had experienced. My parents instilled in me the belief that I was fortunate to have the opportunities that I did and that I needed to make the most of them by working hard and excelling in all areas.” He continued, “This mindset has greatly influenced my drive to succeed as an entrepreneur and investor.”

Zell demonstrated a keen interest in the business world as a young boy. At the age of 12, in 1953, he began purchasing bulk quantities of Playboy magazines for two quarters each and reselling them for a profit of $1.50 to $3. Reflecting on this experience at a 2013 Urban Land Institute meeting, Zell stated, “For the rest of that year, I became an importer – of Playboy magazines to the suburbs,” and considered it his “first lesson in supply and demand.”

His entrepreneurial journey continued through law school, where he established an apartment management business with his friend Robert Lurie. The duo spent a significant amount of time acquiring and renovating distressed properties with the objective of either flipping them or renting them to students. Recounting his venture, he says, “My first real estate endeavor was operating a 15-unit apartment building, which meant all the maintenance and all the economics, so I got exposed to what you must do to make these types of places function.”

By the time of his graduation in 1966, Zell had successfully managed a total of 4,000 apartment units and had personally owned between 100 and 200 of them. He says, “As time went on and my operating responsibilities reduced but having that skill set has remained a positive thing. My ability to step in and get involved in issues that need to be addressed in the business has been impacted by having this experience.”

He then sold his share of the property management business to his partner, Robert Lurie, and returned to Chicago where he did a short stint as an attorney. Talking about how he got into real estate, he says, “One of the most significant things that happened to me was while in law school; I had a conversation with my father, who was a successful businessman and investor in commercial real estate, about his career. My father then described the deals he had invested in, all in major American cities such as New York, Chicago, Los Angeles, and San Francisco, and had a return of 4%.” Zell says, “That’s when I realized that by investing in smaller growth cities where there was less competition, such as Ann Arbor, Madison, Wisconsin, Tampa, Jacksonville, Orlando, Reno, Nevada, and Arlington, Texas, I was in a better position to achieve higher returns of 16%, 20%, and 25%.” This realization influenced his investment strategy and decision to focus on smaller growth cities.”

He says, “It dawned on me that when it was all said and done, the most important criteria for an investor is, ‘What was your competition?’ To the extent that you were able to operate and invest in arenas where there was little or no competition, you got much better deals, and where there were more people, a lot more deals and a lot less attractive returns as a result.” He added, “But the real goal was to find situations where I could operate in a competitive environment that gave me the edge. That became a principle of everything that I did.”

In 1968, he decided to start something of his own and established the predecessor to Equity Group Investments (EGI). The following year, he brought on former fraternity brother and former colleague Robert Lurie as a partner. Together, they expanded EGI into a diversified investment firm that owned and managed billions of dollars in assets across various industries.

In 1973, Zell predicted a commercial real estate crash while the market was still at its peak. Despite facing criticism from his peers, he halted buying assets and started accumulating capital, establishing a property management firm to focus on distressed assets. He says, “It was the biggest risk of my career to date, and it was hard to leave the room while everyone was still at the party.” But less than one year later, in 1974, the market crashed. Overnight, Zell was buying assets at 50 cents on the dollar.

During this time, they financed their debt payments from the monthly rental income generated by the properties. This approach to real estate investing, which emphasized accumulating rental income rather than flipping buildings, was novel at the time and set them apart from most other property investors.

In 1980, Zell and Lurie decided to diversify Equity Group Investments (EGI) investment portfolio by including 50% non-real estate assets within a decade. They sought various opportunities, including companies with large net operating loss (NOL) assets. EGI acquired two NOL companies during that decade, Great American Management and Investment (GAMI) and Itel. GAMI was transformed into a diversified holding conglomerate of dull-tech companies. Itel eventually evolved into Anixter International, a wire and cable distribution company. Today, Anixter is one of the largest companies in its sector globally, with revenues exceeding $6 billion.

Other than being an established business leader, Zell is also one of the most notable philanthropists along with his wife Helen, focusing on education and the arts, with significant beneficiaries including the University of Michigan’s Zell Lurie Institute for Entrepreneurial Studies and Master of Fine Arts Creative Writing Program, Northwestern University’s Kellogg School Zell Center for Risk Research and Zell Scholar Program, amongst others. Additionally, Zell is a major donor to causes in Israel, such as the Herzliya Interdisciplinary Center and the Israel Center for Social and Economic Progress, as well as Jewish causes in the United States, including the American Jewish Committee and the Bernard Zell Anshe Emet Day School. He also donated to the Chicagoland Jewish High School, resulting in the school being renamed the Rochelle Zell Jewish High School in honor of his mother.

In conclusion, Zell says, “Risk is the ultimate differentiator. I have always had a deep and complex relationship with it. I am not a reckless person, but taking risks is really the only way to consistently achieve above – average returns — in life as well as in investments.”